Automation

Prominence of Automation within Accounting

James Mathew, CEO & Managing Partner and Dr. Anuraag Guglaani, Partner, Strategy, Transformation, Technology & Cybersecurity at UHY James Chartered Accountants discuss the importance of leveraging digital workers in accounting to enhance efficiency, accuracy, productivity and profitability while bringing about operational cost reduction

W

e live in a world where technology often drives transience. Decades ago, robots, automation and artificial intelligence were merely figments of one’s imagination, however, today it’s a reality that is here to stay for the long haul. In the current economic climate, boundaries are blurred when it comes to the technological and physical realms of businesses. Technological advent has not only catalyzed business evolution but also transformed business value chains forever.

Reflecting on the expansion of global businesses, we can trace the journey and progress of automation over the years. In its nascent stages, automation largely revolved around the use of robots in the manufacturing sector, however today automation and artificial intelligence have made inroads into almost every professional realm, including finance & accounting.

Through this article we will take a closer look at the modernisation of the finance & accounting function and the prominence of automation in accounting.

History of automation in accounting

Contrary to conventional belief, automation has always been at the heart of the evolution of the finance and accounting function. A quick recap reveals that way back in the 1880s William Burroughs invented the adding machine, which was the first step towards automation in the accounting process. Later in 1955 General Electric started using UNIVAC to process payroll, becoming the first company to use a computer for accounting. Almost two decades later ‘Visicalc’ was introduced as the first spreadsheet software in 1978, only to be followed by the launch of the hugely popular Microsoft Excel in 1987.

James Mathew, CEO & Managing Partner, UHY James Chartered Accountants

Prominence of automation in today’s accounting landscape

Technological advent led to automation undergoing a paradigm shift. The rise of Robotic Process Automation across industries also had a ripple effect on the finance & accounting landscape. Industry surveys estimate that almost 50% of roles in back-office functions within finance and accounting can be automated. Automating accounting processes will exponentially expand the horizon of what the finance and accounting team can achieve collectively.

Currently most finance and accounting teams spend extensive hours collating data and ensuring data quality is maintained. This leaves the team with little time for analysis, reporting and strategic inputs. Implementation of automation within the accounting function will ensure transaction work that took hours, can be completed within a matter of minutes with no room for human error. Introducing automation will ensure transactional work is taken care of, thereby allowing finance and accounting professionals to focus on delivering value through predictive analytics. The introduction and implementation of new technologies in the finance and accounting department will also bring into play professionals like strategists, data scientists, IT professionals, marketers and entrepreneurs who will be instrumental in driving the finance function of an organization.

Benefits of automation in accounting

- Automation in accounting wields potential to enhance efficiency without compromising service and quality.

- Automating accounting functions will provide accountants with ample time to develop thought through strategies that will add value to the financial health of an organization.

- The use of automation software will ensure 100% accuracy in finance and accounting processes.

- Automation provides easy and effortless data retrieval – be it client, vendor, expense, or sales information.

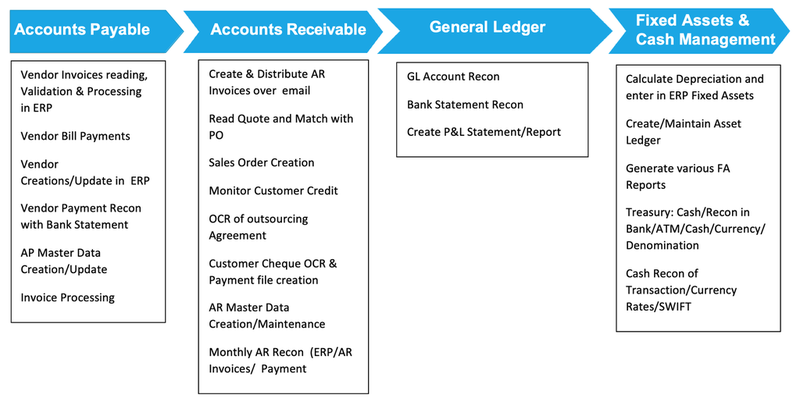

Accounting functions most likely to be automated

A diagram of accounting functions. Credit: UHY James Chartered Accountants, UAE

Insight into the rise of automation in the Middle East

Automation has made steady progress across the globe, however, GCC countries have embraced and adopted automation at a much quicker pace. Most GCC countries are guided by national digital strategies that were developed owing to a shift in consumption patterns, leaning towards digitalisation and a surge in the digital workforce.

Some of the initiatives that promote technological advancement in the region are the UAE Strategy for Artificial Intelligence (AI) and Saudi Vision 2030. UAE and Saudi Arabia are among the first few nations in the region who have made heavy investments in robotics and artificial intelligence, confident in their belief that technology will be the gamechanger in shaping the future of their economy.

The future of finance and accounting

As finance and accounting functions turn over a new leaf, powered by automation, there will be an indelible impact on the future of accounting professionals. From a futuristic perspective, accountants must sharpen their analytical capabilities, enhance technical competence in areas like data analytics, data science, business intelligence and information systems and build expertise in areas of financial planning. It is true that automation in accounting is still in its nascent stages, however, given the pace at which digitalisation is progressing in a post pandemic landscape, it is only a matter of time before automated accounting becomes the ‘new normal’.